Our team has provided employers of all sizes with solutions to their Employee Benefits challenges for 15 years. We are confident in our results and look forward to making your business our next success story.

Contact us now to learn how we can achieve results like these for your business.

A 200+ Employee Restoration Company

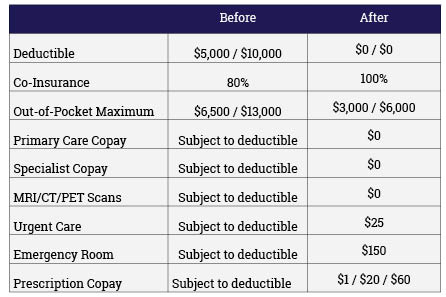

This fully-insured client was facing an annual rate increase of 37.3% on their already-high-deductible HSA Qualified plan. With individual and family deductibles of $5,000/$10,000, the company couldn’t push any more costs to its employees.

Tired of the same old “renewal dance” each year, which only left them with higher deductibles and higher premiums, the company was looking for real solutions.

Our Results

We completely cleaned house and focused our efforts on solving the cost problem by identifying the high-utilizers of the plan and underwriting them with a fair and transparent pricing methodology. By moving to an unbundled health plan and implementing a prescription drug partner with pricing incentives, we were able to design an affordable plan for the company and its employees.

- Reduced annual deductible to ZERO

- Kept rates flat at renewal

- Provided fully-covered care with no employee cost-sharing

- Drove employees to higher quality and lower cost network providers.

A 150 Employee Logistics & Finance Company

This company faced a dual challenge: Their premiums were about to go up by 10% and the CFO didn’t have the time, budget, staff, or technology to properly manage his HR and Benefits duties on top of everything else. Thinking they had no choice but to accept their expensive renewal, they came to Moore Benefit Resources as a last resort.

To the CFO’s surprise, we were able to analyze their current plans and suggest improvements based on their historical data. After uncovering that their health plan was not ERISA, Section 125, or ACA compliant (due to a previous broker’s oversights) we were also able to bring the plan into full compliance.

Our Results

The company saw a savings of $128,000 in its first year! With this savings, they were able to allocate funds to implement a payroll software package that integrated with Moore Benefit Resource’s benefit administration tool and saved hundreds of hours of manual work between enrolling employees in benefits and cutting payroll checks.

- Saved. $128,000 in the first year

- Avoided a 10% increase in medical premiums

- Implemented new technology to save time and money

- Brought plan into full compliance

- Added Life and Disability coverages for the first time to help compete for talent

A 120 Employee Financial Services Company

Hoping to reduce their healthcare costs, this company switched to Reference Based Pricing (RBP). Unfortunately, not all RBP programs are created equal. Two weeks before Annual Open Enrollment, the company approached Moore Benefit Resources to ask for help.

At that point in time, the company’s problems included:

- Eight separate balance bills that had escalated to the point of potential collection and threatened to impact key employees’ credit scores

- Rising costs as the RBP vendor collected 12% of every bill in fees

- An HR nightmare as a team of unprepared Human Resources professionals stepped in to fight the balance bills after the Legal team gave up

Our Results

With no time to lose, Moore Benefit Resources got to work and implemented a solution with a different RBP vendor. We leveraged existing contracts with local providers to eliminate the fear of balance billing and proactively put agreements in place before services were rendered.

By the time Open Enrollment occurred, we had:

- Negotiated $45,000 of savings on the Stop Loss Contract

- Found $37,000 of savings by implementing an RBP vendor that aligned their incentives to the employer.

Moreover, after a year on the new plan, employees of the company incurred zero new balance bills.

These results may not be typical for many benefits brokers, but we are confident we can achieve dramatic savings for your company and employees. Contact us now to learn how #MooreIsBetter!